TraderMetrics Newsletter Number 2

January 25th 2006

Hi and welcome to the second edition of the TraderMetrics Newsletter.

In this issue we discuss market making and how to handle incoming calls.

The special offer is still open to those who have not purchased a copy of TraderMetrics (although those who have bought will also benefit!):

We have prepared an alternative evaluation file for you. This is a 4 hour file based on the EUR/USD with plenty of action and news items. Your task is to interpret the news items and trade accordingly. There are a few chart patterns and quite a range!

The files required are in a zip file which can be downloaded from the dadfiles library page. The file is called 'alternateeval.zip'. To install the files, first rename the existing evaluation file (located in the \TraderMetrics\dadfiles\EvalDemo directory) to something else (such as evaldemoold.dad).

You then start up TraderMetrics. If you have a license already, enter '1234' as the password.

The art of market making

Traders ask why I think learning market making is relevant to today's Internet forex trader. It is about what lies at the very core of trading forex - to understand what actually moves markets. Yes, it is participant's views and ideas, but it is how, when and of what size they place their orders which dictates how the market will react, becuase essentially it is a transfer of risk. Risk appetite is different for every market participant, but the market makers, or at least the banks that provide liquidity to their customers and the market also have their limits and it i how these institutions handle this risk that is crucial to getting an understanding of the market.

Normally, you would not get the opportunity to see it from their perspective, but with TraderMetrics you can and I believe that everyone will get a greater insight which will benefit their trading. I can tell you that the brokers do not want their customers to have this!

Market making is becoming a

lost art in all markets, not just forex. This is a shame, because market making

is at the pointed end of trading. As a market maker, you are the first to know

of anything that is going on. If you are not 'sharp' enough, you can become the

last to know! That is the nature of the forex market - speed is of the

essence.

Modern airline pilots who have trained to be managers of systems have missed out on 'real' flying. Many would say that is for the better, but again and again, you hear of problems because the pilots did not have that intuitive sense that comes from experiencing what it is really like to fly. So it is with forex traders. It is no coincidence that the best fund managers were once market makers in banks.

Taking the airliner analogy one step further, retail forex traders are nothing more than passengers.

History

In all markets, there have been market-makers - professionals who have been willing to match buyers and sellers by quoting a two-sided price. This is the 'spread'. They are not to be confused with brokers, who match buyer and seller for a commission, but are not pricipals in the deal. We are talking here of real brokers, not the 'brokers' who are found in our market.

In the stock market, these people were called 'jobbers' and there job was to make sure that there was a market in the given stock. The forex market once operated on the same lines and dealers met to do business. In London this was at the Royal Exchange, in Paris it was the Bourse. Eventually, in many centres, a 'fixing' system was developed where banks, acting on behalf of customers ment at the central bank or the stock exchange to 'fix' a price for the day. This was done by supply and demand - a kind of bidding system where a trader would either 'bid' until a price was reached where the sellers were happy to trade. The price was then 'fixed' for the day and business was often done for the next 24 hours at this price plus a spread. A 'notional' fixing still takes place in many countries.

In London, the market developed in a different direction and already by the 1930s, business was being done by telephone and between London and New York by telegraph. A tradition developed where banks indicated that they were 'in the market' by quoting a 'two-way price'. In other words a price where the quoted party could buy or sell. This was an exclusive club and banks quoted a closer spread among each other than to customers, who often just got a 'side' after declaring whether they were buyers of sellers. Spread were huge (100 points or more) but the amounts were very small.

WW2 put a stop to the development of the market and severe restrictions were introduced. Clandestine business did go on - for example, the Germans and British both dealt Sterling/Reichmark through Swiss banks. In 1944, a plan was developed to shape the forex markets after the war ('Bretton Woods') and the London market did not start again until 1952 when the Canadian dollar became 'convertible'. Not a good time to be a forex trader!

The period up to 1971 was one of the fixed exchange rate system straining at the seams, as the Sterling (GBP) lost its influence and the U.S. Dollar became progressively weaker. The West German deutschmark and the Japanese yen became stronger due to their post-war economic strength and the Swiss franc became a home for 'hot' money.

Communications improved and the telex was the main method of doing business. In London, all trades had to go through broker firms, but banks could trade directly internationally. More and more banks opened in London and the market exploded around 1973. To be part of the 'club', you had to quote a two-way trading price, otherwise you were a 'price taker' and as such, got a lousy spread.

A major change in the way business was done was the introduction of the Reuter dealing system in 1982. The telephone was being used as well, but there were obvious security problems (although billions were transacted between banks on the phone and I never once heard of a default - 'my word is my bond' - a done deal was a done deal!)

The Reuter system was really a predecessor of Internet chat and banks could contact each other for prices. The TraderMetrics conversational trading is based on this system which is still in use to this day. Conventions were in place on how to conduct yourself and the 'Model Code' of the A.C.I. (Association Cambiste Internationale) was universally accepted.

Although much of the business between banks is done on the EBS (Electronic Broker System) or the equivalent Reuter D2002 system, conversational dealing still has its role to play, especially in emerging markets, or in dealing with non-banking financial institutions.

The Golden Years

The best time to have been a forex trader was the period 1985-1995. There was increasing volume all the time as more and more banks were hooked into the Reuter system and more currencies became freely tradeable. There were plenty of customers who had no choice but to accept wide (20+ pips) spread. There were some huge orders from the corporates, hedge funds and central banks who at that time were not as professinal as they are now. The market was driven by the buying and selling, but rumours put around the market could trigger waves of buying or selling. There was not the same 'isntant dissemination' of news as there is today. Technical analysis was also just starting to be used.

In the mid-1990's huge hedge funds came to the fore, and the amounts they were doing were staggering. The tables were turned - from having the desire to be the first to get the order, it was better for your bottom line NOT to be the first. If a hedge fund 'touched' you for $100 million, everyone somehow knew that you had the order and the market ran away, leaving you 'holding the baby'.

Some banks tried to take on this risk but there are limits to how much you can take on - a prime factor in why markets move as they do. At the same time, the banks became fed up with the 'voice brokers' - those who created a market by receiving orders from banks and broadcasting them over 'squak boxes' and with Reuters, who did not want to 'rock the boat' as they were earning millions with the system.

The EBS system was formed by a consortium of banks and today it is the prime place of doing business in the major currencies. It is not accessible by any other than those who have sufficient 'credit' and are banks to participate. TraderMetrics replicates this system, too - but that is another subject.

Lessons in Market Making with TraderMetrics

The principle of being a market maker is that you attract turnover by quoting a price of sufficient quality that banks will call you for a quote, without quoting so close that you cannot earn money from the spread. Markets are not static and they can move instantly. So a market maker does not sell then wait for someone to sell on his buy price. Ho (or she) is checking the pulse of the market by watching price action with the broker, although there are many games of 'spoof' going on here. He may be calling out to other market makers, again to get the feel of who has what position.

For example, the broker is 10-15 3 X 8. This would seem to indicate there is more on the ask side, but unfortunately, it is not always possible to see what is behind these orders. For example, are there larger sellers at 16 or 17?. To be honest (and you can probably follow this on Oanda), the market is usually pretty much in balance - otherwise the price would not be where it is!

If you as a market maker have just been given $25 million at 10 by a customer, you would probably want to try to sell at 14 or so. You have some choices: Put the order into the broker, therefore broadcasting to the market that there is a seller. You can 'test' the market by putting out an offer at say, 13 in $3 million. But before this, you would be probably be wise to call out and see what the others are quoting. Do you ask for an amount of $25 million? That depends on how sure you are of getting a decent price! If the market is not very volatile, there is a chance that you will find a bid better that 10. But if your customer has been out selling elsewhere, there are probably others in the same situation. You never know!

If you call out and get a price 06-11, you are in a bit of trouble! If you slam the broker at 10 you may only get $3 done and then where is the next bid.

What you need is a healthy flow of calls coming in (and a good customer desk who can lay off the risk!). Unfortunately TraderMetrics doesn't have such a desk (unless you count the Autotransact clients).

If you are getting calls in, you can try to quote 'inside the spread' so that you don't give away your direction and at the same time make an attractive price to a caller. You could quote 11-13, for example, or if you are really bold, quote an 'either way' price, in the format "1.2412EW. It is all about risk - how much are you prepared to risk?

This would all be fine if there was plenty of time to think about it, but often this is going on several times a MINUTE!

Accepting a loss

As a market maker, there is no time for stop loss orders! The buck literally stops with you. You have to be disciplined and realistic about taking a loss. If the market moves, it moves - no amount of wishing is going to bring it back, and you can't sit there like a paralysed duck. You ahve to keep making a market and that means that you have to be almost 'square' (that is, no position) most of the time. So be prepared to admit mistakes early and DUMP the position. If you got hit for $25 million and the market appeared 'thin' and volatile, you would probably off load the lot even at a small loss- and live to fight another day!

Front Running

Although market makers do not normally take longer term positions, there is nothing wrong with front running. This means that you buy or sell in anticipation of your customers buying or selling - like stocking up. Very often the best time to do this is if you do get a couple of calls out for $25 m and 2 quotes come back, say 10-14 and 11-14. Suppose you got the first quote in and have dealt. You could hit the second price and then hit the broker for the $3m at 10 and see if you can create a little panic out there. You might force the two buyers to 'ditch' their positions and if you have a flow of calls, there would be a chance that you have created a 'landslide' - at least temporarily.

Accepting Incoming Calls with Tradermetrics

First of all, you have to set up a session to accept incoming calls. This is done from the start up menu. Leave the settings as they are and click on the tab setup 2.

Here you will see the settings for incoming calls. The default is 'Auto, Depending on Market Volatility'. This means that with this setting, the more volatile the market, the more calls you get. If you want a constant stream of prices, click on the Manual option button. You can have calls right down to one every few seconds, but at this stage, I recommend that you take a call around every 2 minutes, until you get used to taking calls.

Set the 'Time Before Caller Loses Interest' to 60 seconds and for now, set the 'Percentage of Calls for Specific Amounts' to 100. Leave the Maximum Quote Spread to 10 and the number of conversations as it is, on the default '4'.

Go with these settings (assuming you want to use the EUR/USD pair - otherwise select another pair).

The user defaults are largely a matter of personal preference (we will discuss these in a later newsletter). This is how I set mine:

In the Data supplier, set the Market Price Spread to 5 and in the Spread Control, set the minimum spread to 3 and the maximum to 8. Set a tick in the box. Select a file (or live rates, if you have them) and click the 'Accept Settings' button. After the session has started, check the minimum and maximum spread values (depending on the rate file, they may default to different values)

Viewing Incoming Calls

There are several ways to take an incoming call. When there is a call, the incoming call icon at the bottom of the screen will flash. You may click on this.

You may also click on the Information window when 'Incoming Call' is displayed:

If you have the scrolling message bar turned on, you may click on the 'New Incoming Call' message as it scrolls: (You may adjust the speed of this in the 'config' area).

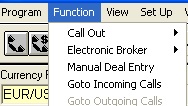

Finally, you can go to the Function>Goto Incoming Calls menu item and accept calls, when available:

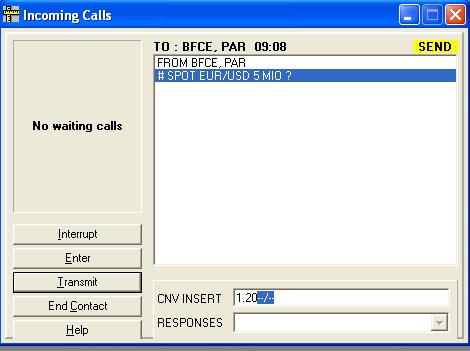

When the 'calls waiting' box appears, you click on the white area to open the conversation area.

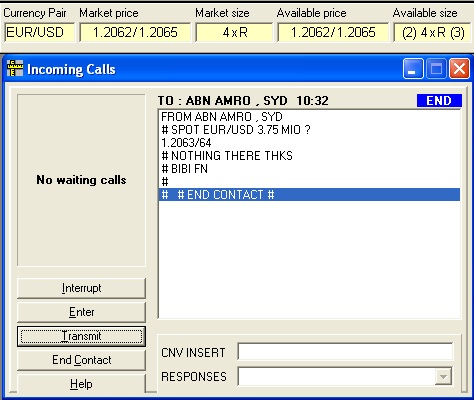

The request for a price from a bank appears in the conversation area. Our session has been set up to accept requests for up to the dealing limit, namely €10 million. This request is for €5 million. These are the normal amounts dealt between market makers in the forex market. The cursor is at the price. If it is not, hit the 'insert' key on your keyboard to restore it. You are expected to quote a price. The 'big figure' is supplied, but care is required when trading around the figure ('00'). You may change the big figure. (In most cases, the 'polite' customer will ask you to check the price if it is off by 100 points, although don't expect this mercy in a network session!).

Quote the price by referring to the market price at the top left of the screen and your current position. Quote in the format 64/67, or 64-67, 64*67 or 64+67

As we have set the market price relatively wide, we can quote 'inside' the market spread to be competitive, yet remaining neutral. In this way we will give out the signal that we quote competitive spreads.

In this case, the caller has responded that he does not want to trade on our price. and ends the contact. You may also click 'end contact' to minimize the window.

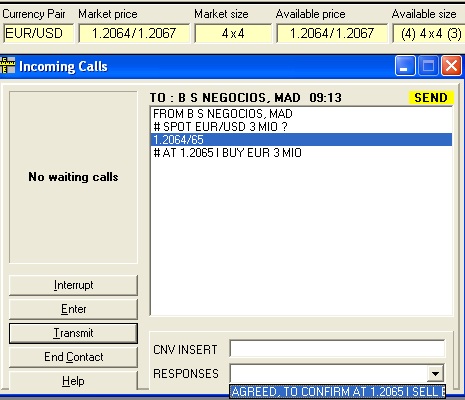

If you quote a 'shaded' price, because either you think that the market will go lower, or you are long and wish to sell, or you want to know what the callers interest is, you may well get dealt on. In this case, the market was 64/67 and we quoted 64/65. So the caller has taken us on our price. He indicates exactly what he wants to do by stating intention, price and amount. We have to respond by agreeing the trade, which we do by selecting the appropriate response from the RESPONSE drop-down menu and clicking the 'Enter' button. You may then click 'Transmit', or you can continue to enter the value date and the instructions and then 'Transmit'. After this, you may 'End Contact'. The deal will be entered in your Journal and in your position.

Why write the value date and instructions?

In the Interbank market, all trades are confirmed immediately after the transaction, to ensure that both parties are in agreement. The value date is the spot date, normally to business days hence. This is automatically calculated by the program. In TraderMetrics (stand alone), all instructions are 'standing', or 'standard'. This means that each bank has in it's systems a file of where each counter party wants the respective currencies paid to. In U.S: dollars, this would be a bank in New York, in Yen, a bank in Tokyo, etc. In practice today, trades are 'netted' against each other and the resulting balance is transferred. Nothing for you to worry about - that is a 'back office' function.

Can I refuse a trade?

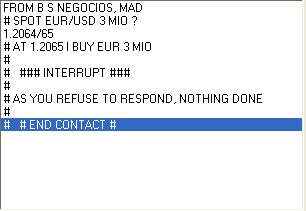

NO! My word is My Bond. Your credibility as a market maker is at stake. If you quote a 'firm' or tradeable price, especially for a specific amount, you have to substantiate it. You should never get in this situation

In reality, you would have been called by phone by a very irate trader, and your credibility as a market maker will be blown!

Can I change my price?

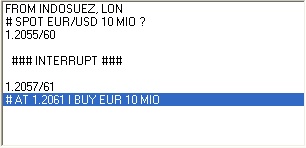

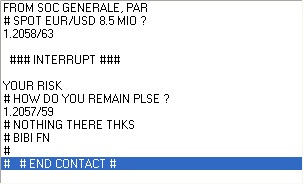

Yes, you can at any time before the other party trades on your price hit the 'INTERRUPT' button and quote a new price. This means that you have taken control of the conversation back and the other party cannot trade. You can quote a new price, or say 'YOUR RISK', which means that the other party can still attempt to trade on the existing price, but you are not obliged to trade.

Normally, the other party will say thanks and goodbye, but they may ask 'HOW DO YOU REMAIN?', which is a request for a new price. You can then quote a new price.

In the next newsletter I will explain what options you have when you are given or taken on your price.

If you want to get the truth about retail forex, click the above graphic

The information contained herein is

not

intended to be, and should not be construed as, a recommendation

regardingany potential purchase of an investment or the rendering of risk

or investment advice. Trading in foreign exchange is a

business

associated with risk and by entering the site you acknowledge

and agree to

be fully liable for any actions or investment

decisions you make in

connection with this newsletter or any linked

site.

Link to Forex Trader Mentor web site