TraderMetrics Newsletter Number 3

February 13th 2006

Hi and welcome to this Newsletter.

This issue deals with stop loss orders: How to set them and learning the 'news trading' strategy, and the second part of a series on market making.

If you are actively trading and have aaccounts with brokers, you might like to participate in a survey I am doing for the Forex Trader Mentor newsletter. I am asking if brokers affect your profitability. Please click on this SURVEY link to participate - it will only take a few minutes to complete.

The art of market making-2

What do you do when you are given or taken on your price?

In this continuing series on market making, will take a look at what happens when you are dealt on your price. Obviously, you have to react, else in a fast moving market, you will be 'steamrollered'.

The idea of being a market maker is that you make your money from the spread. Ideally, you will have enough traders calling you that you will be able to make a competitive enough price to make money , at the same time getting enough trades to find out what is going on in the market and shade your price accordingly. What do i mean by shade? I mean, move your quote enough to make it attractive for someone to trade on the opposite side to the last trade.

In the 'good old days', where the spreads were comparatively wide and the markets were slower with less turnover, market makers could do exactly this. For example, the market maker (MM) quotes customer A 45-55. Customer A buys $1 million at 55, so the next customer, customer B, gets a quote that is slightly higher, such as 47-57. All things being equal, customer B is interested to sell at 47, thus closing the loop.

If customer B is not interested in selling, or even worse, also buys at 57, the MM has a small problem. If he is fast enough, he can see if the broker is still showing offers better that 57 and take the offer. Or he can call out and see if the other market makers have not yet got the idea that the market is perhaps 'bid' and perhaps find a 53 offer to buy. He can also 'take on' the position and assume that he has covered the buying interests of customers A and B and just wait for an opportunity to buy back at a lower rate.

Trading Limits

The problem here is that MM will be given trading limits. This prevents MM from holding an excess short or long position. In fact, an efficient market maker will not carry positions, being a 'super scalper'. Such traders can turn over huge amounts in a trading session. In the days before electronic deal capture, I knew traders who wrote over a thousand tickets per day!

In a market with high turnover and many market makers, it is no longer possible to sit back waiting for the orders to come your way. To begin with, the quote has to be competitive; 10 pip spreads will not attract any trades in a 3 pip market. Secondly, if you want 'reciprocation', you have to quote close prices, so that you can also get a close price when you need it. In doing this, you become a part of an exclusive club of market makers.

Therefore, you need to get a feel for the price action, by observing what goes on with the broker (although you have to remember there is often a game of bluff going on here), quoting your own price and seeing what reaction you are getting and finally by calling out and seeing what prices you get back.

I hope that you can see how the interaction between market users, or price takers and market makers cause the price movements. Market makers are by definition, not paid to sit with huge directional positions. They have trading limits, which means they have to play a game of 'pass the parcel'. The customers, on the other hand, often do not have such limits. Generally, they just want to get their business done and for some, liquidity is more important than small fluctuations in the price.

Is that your full amount, sir?

That is why some large customers would like to have a price in their 'full amount' and get the trade done in one go. For this, they may be willing to accept a slightly wider price. If the market maker handles this well, he will be able to 'trade his way' out of the position. Try it in a session. Use the Auto Transact set for CCC customers and set the dealing and quote amounts to 25 million with a time spread between 60 and 120 seconds, whilst setting the position limit to 50 mio. To make things more interesting, when the session starts, set the minimum price spread to 5 points (assuming it is a EUR/USD session) and the market spread to 'small'. Bear in mind that if you hit a market maker on an outgoing call for a large amount, you will temporarily distort the market. Also, bear in mind that if you put large offers or bids with the broker, you will be sending out a big message about your intentions ('telegraphing').

Try and quote against your position: That is, if you are long, quote a slightly lower price to attract buyers. You must always stay within your position limit, so just get rid of the position if you are in danger of breaking it. Don't be proud - take a loss when you have to.

You should have great fun! The dice are loaded your favor, so you should make money. You can take a look at the statistics to see how you are doing. We will look at these statistics in more detail in a later newsletter.

What do you notice? You can expect to forget all about where the market is heading any further forward than 10 seconds! This is how the mind of the market maker works.

Either Way

An either way price is where a market maker quotes you the same price to sell or buy. Any self respecting trader will not pass up such a price, and even if it hurts, you should trade on the price. If you are good enough, making either-way or 'choice' prices can really force the hand of other traders.

So, now you have experienced a little of what market making is about. I trust that you have begun to see how the forex market really works and how the turnover can reach $2 trillion per day as a result of all the parcel-passing.

Stop loss orders in TraderMetrics

What is a stop loss order?

A stop loss order is an order placed by a trader to protect against excessive loss on a position. The opposite of a stop loss is a profit take, or limit order, which 'locks in' a profit at a pre-defined level.

A stop loss order works by the trader instructing the bank or broker to execute a trade to close out a trade at a pre-determined level.

Originally, it was designed to help traders who had open orders while they were not available to trade, such as at night. Most bank based traders have developed their own discipline of cutting losses and running profits, without the need to place an order with another bank or trader.

It has since become a standard method for Internet traders under recommendation from everyone - brokers, courses, mentors, etc. There is good ground for this: firstly, the forex market can be prone to sudden movements as a reaction to unexpected news events which can easily wipe out a trader who is trading on margin, especially with high leverage. Conversely, there are occasions where the right position is held at the right time and a 'windfall' or unexpected profit may be gained.

Secondly, there is a school of thought that says before traders enter a trade, an outcome - be it a loss or a profit, has to be pre-defined. This has two effects, the first being that a Risk Reward ratio (RRR) can be defined for the trade. This RRR should be consistent for all trades so that the level of consistency can be monitored. The other effect is that a trader, by accepting that some trades are losers and some are winners, cuts himself off mentally from the trade once it has been entered. This prevents the 'micro-managing' of a trade and allowing the trader to try and out-guess the next move in the market.

Unfortunately, setting stop loss and limit orders gives the game away to brokers and they can often judge the risk appetite of a trader by how the stops/limits are set. Some brokers openly 'bucket' their customers. That is, they take on the other side of the trade instead of behaving as a broker and turning the trade with the market maker. It is a matter of taste whether a trader considers this ethical behaviour.

Brokers often say that the stops are 'guaranteed' in their promotional material, so that you don't suffer slippage. Slippage is where an order is done at a worse price than you set the order. Under normal circumstances, they can substantiate this claim, but in a moving market - when you need a good execution - the broker will widen out the spread - the difference between his buying and selling rate, which will trigger stops.

Essentially, to set a stop order, you have to have an open position. (Although you can enter a trade with a stop - a 'stop entry') Many broker platforms automatically ask you if you want to set a stop and/or a limit order on trading. If you have bought, you would set a stop order at a lower price. If you have sold, you would set a buy order at a higher price.

How far away should a stop be set?

An important question. One method is to set your stop at a percentage of your capital. Bear in mind that this has to be pre-defined and should be consistent for each trade. The more you 'lever' your capital, the closer you will have to set your stop to entry. Some traders take an arbitrary pip amount, depending on the currency pair. Different currency pairs have different pip values. A pip on 100,000 Euros in EUR/GBP is worth 10 GBP, or $17.50 approximately. A pip on $100,000 USD/SEK is worth SEK 10, or about $1.25. Of course, these values are reflected in the spreads, so a 30 pip stop in EUR/GBP is a completely different thing to a 30 pip stop in USD/SEK.

Some people think that 30 points is acceptable in EUR/USD. This should avoid the 'spiking' that happens with broker platforms. (Brokers would say that these 'spikes' or sudden deviations in the prices occur in the Interbank market, but sometimes the brokers go 'stop hunting')

What about the limit order?

As a rule, traders should not be looking for a RRR of less than two, or more than 3. I could write a whole book why, but I won't here. Suffice to say, that a RRR of less that 2 requires that you have a system of trading that produces substantially more winners than losers. Going under 1:1 is trading suicide!

Example: We have bought €100,000 at 1.2025 against the USD. We set a stop order at 1.1995 and a limit order at 1.2085. This gives us a 2:1 RRR. Most platforms will create an automatic 'OCO' (order cancels order), which means that if one of the orders is done, the other gets cancelled. This is not always the case, though.

On most platforms, the order is set to be executed 'on the bid' or 'on the offer', depending on the direction. In our case, if the market is 1.19 96-99, the stop order will not be executed. However, when the price is 95-98, the stop will be executed. In a fast moving market, unless guaranteed stops are exactly that, the stop may be executed the next available trading price, which could be 93 or even 90. Even if the price 'touches' but doesn't go 'through' the stop, you can get executed.

On a limit order, you are normally given a choice of whether the order is executed on the bid or the ask (offer). In our example, if the limit is set to execute on bid, the price would be 1.20 85-88. If it is set to execute on offer, it would be executed when the price is 82-85, hence at 82.

Trailing Stops

You can always cancel orders. On most platforms you may set a 'trailing stop'. This is a stop loss order which can be set to trail the current spot by a margin of pips. In this way, you can capture the high, minus the number of pips you have set. For example, if we had set out stop at 30 pips trailing with no limit order, then if the spot went to 1.2150 and then fell back, our stop would be executed at 1.2120. This order is useful for locking in a certain amount of profit on a trade.

How stops work in TraderMetrics

The operation of stops varies between a full session and a margin trading session. In a full session, you do not have to have a trade open to be able to set stops, whereas in the margin trading session, you can only set stops against the current position. Why? Because setting multiple stops without reference to the margin limit would be impossible!

To set stop loss orders, you have to pause the session. This is done by clicking on the 'pause' button. Click 'OK' to setting stops. The Stop-Loss Order Setup box will appear. Your current position information will be shown. To set an order, click on 'New Order'

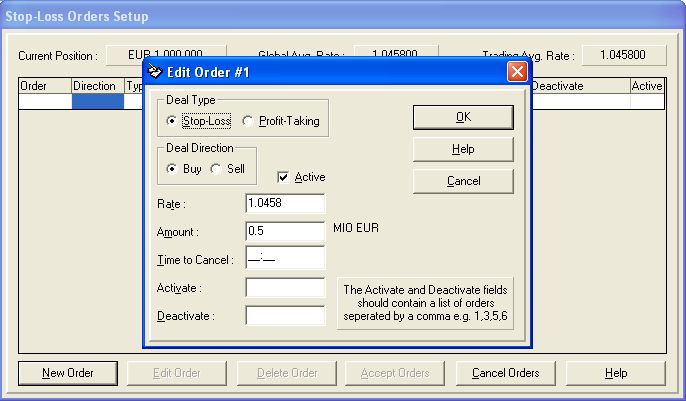

A new dialog appears 'Edit Order #1'. There are some defaults in the fields, but these may be changed.

Step 1: Choose the type of order. Stop-Loss or 'Profit-Take'. It is important (in this system) to only set a stop against a long position lower than the current spot and a profit-take higher than the current spot. Otherwise, when you accept the orders, the trades will be executed immediately!

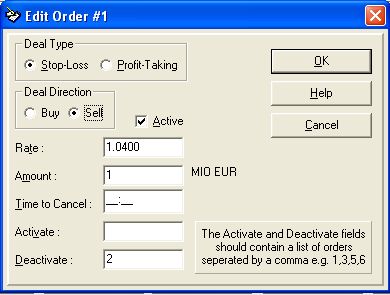

You may set a time limit for the order, in hours and minutes if you wish. You may also set the order to activate or cancel another order. In this case, we will set a profit take order as order #2, so we will deactivate that order

Make sure the order is in the right direction and set the activate check box.

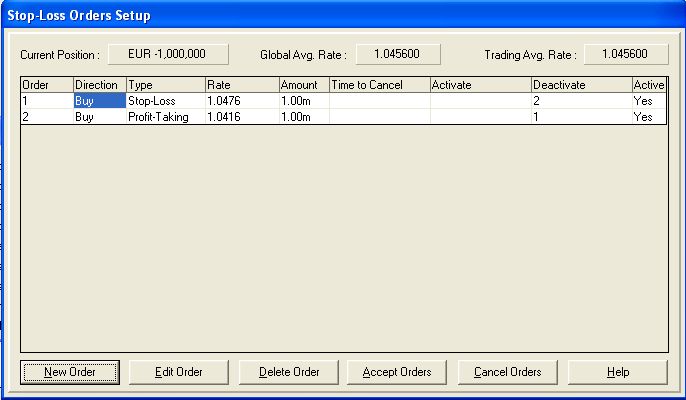

Clicking OK, will post the order to the list. Proceed to the next order. You may edit an order by highlighting and double-clicking. When you are ready, click the 'Accept Orders' button

If you resume the session, the outstanding orders will immediately be cancelled. Otherwise, the orders will be done according to the settings.

Stop Loss Strategies

You do not have to have open trades to enter stops. A good example would be to set a so-called 'straddle' around the issue of economic news.

The scenario is that there is some news such as the release of non-farm payrolls. If the numbers are not in line with market expectations, there will be a sharp reaction. This could be in either direction, so you want to be able to jump on the new 'trend'.

Please bear in mind that brokers hate 'news trades' and so you have to be very careful how and when you do this. Traders call it 'coming under the radar'.

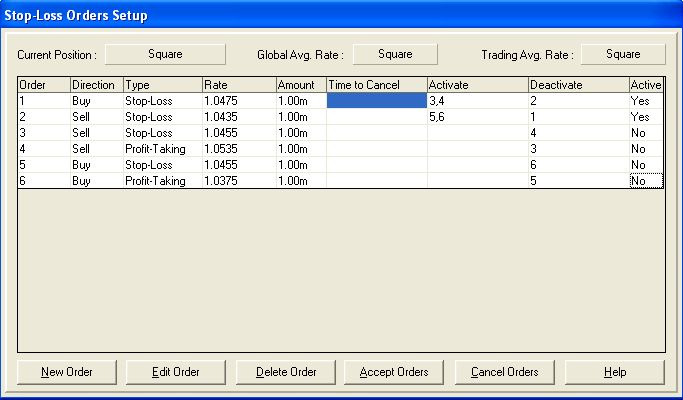

String of Pearls

Set a stop entry for a purchase and a sale, with a corresponding stop and limit if one of these orders get executed. Complicated? Yes, you need to plan the trade carefully. (NB: For the reason just stated, I don't know of (m)any brokers who will let you set this 'string of pearls' order - please let me know if your broker does!)

The orders can get quite complex, but I emphasize, you must check out the logic of the scenario before you place the orders.

Note that in a margin trading session, you can only set one order of each type (i.e. stop loss/buy, stop-loss/sell, profit-take/buy and profit-take/sell); however, this still allows you to set a limited trading strategy.

If you want to get the truth about retail forex, click the above graphic

The information contained herein is

not

intended to be, and should not be construed as, a recommendation

regardingany potential purchase of an investment or the rendering of risk

or investment advice. Trading in foreign exchange is a

business

associated with risk and by entering the site you acknowledge

and agree to

be fully liable for any actions or investment

decisions you make in

connection with this newsletter or any linked

site.

Link to Forex Trader Mentor web site